We began with the US on holiday. Bond futures were offered in the morning, probably because the few that were trading at the time thought Ackman is a credible critic of the Fed's credibility when he said they need to go 50bps in March. Lol. Surely, everyone in the Rates business knows better than to listen to Equity PMs on central bank credibility? I mean, ever heard of 5y5y inflation swaps or any other proxies for inflation expectations?

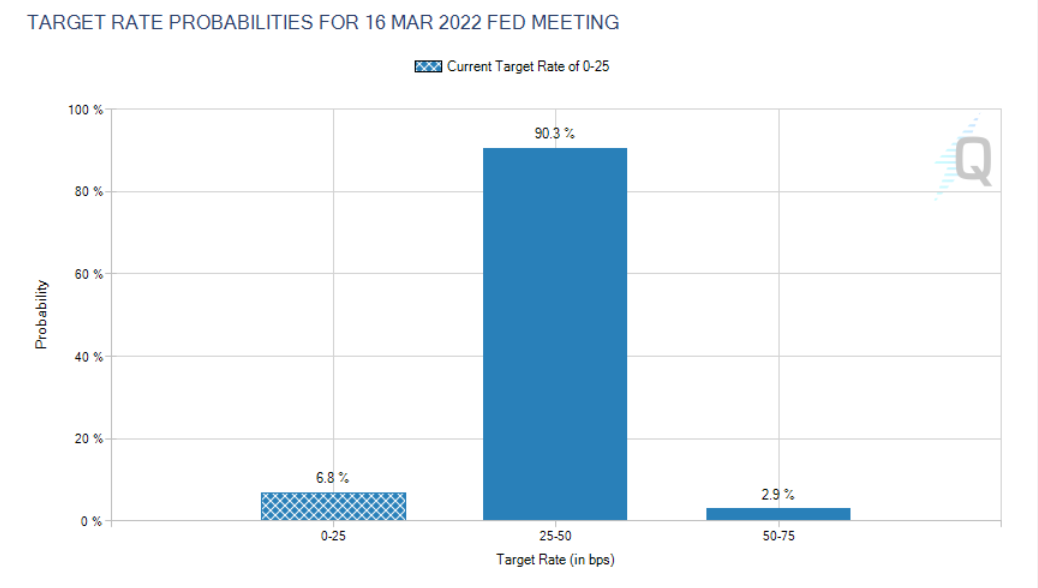

Given the pivot from the Fed and the universal consensus (both within and outside the Fed) that rates are going to rise soon and 3-to 4 times this year, it’s not odd that the market would price in some odds of a 50bps hike in March, though it’s incredibly unlikely the Fed takes that route if you analyze their desire to avoid flattening the curve and considering medium-term inflation expectations do not seem unanchored.

There were also stories about the BoJ debating messaging on rate hikes? Lol. The latest inflation print in Japan was 0.5% - year on year, not month on month. Yes, deflation may no longer be a big risk, but normalization of policy? Kuroda is the last of the Great Doves and I feel confident that he will retire next year with rates at the lower bound. Kuroda, when asked about the start of normalization of policy:

Meanwhile, PBoC slashed the Marginal Lending Facility rate by 10bps - which subsequently resulted in reductions in the 1y (reference rate for corporate loans, fell 10bps) and 5y (reference for mortgage loans, fell 5bps) Loan Prime Rates. The asymmetric reaction was reminiscent of 1H 2020 and a reflection of the panel banks towing PBoC’s preference of not fueling property bubbles. This follows cuts in banks’ required reserves ratios and is part of a wider, concerted effort to bring the economy back on track. China's trajectory post-Covid is one of the many things different about how this cycle is panning out. Here’s a useful China policy dashboard via Bloomberg:

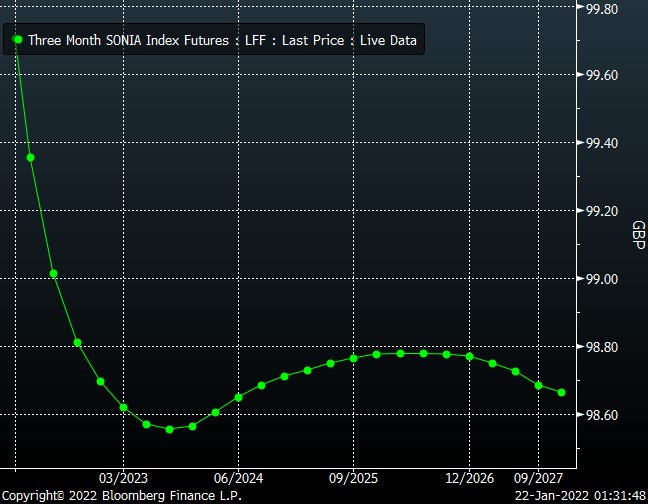

UK jobs and inflation data came and went without making a dent in the pricing for the February meeting, where the market was already expecting the BoE to hike rates by 25bps, as medium-term inflation expectations remain high. UK's terminal rate's priced around 1.5%, which certainly seems above their neutral (a dirty word for what the economy could handle), which has led to the SONIA curve inverting by the end of next year.

The big impact data release this week was the Consumer Sentiment Survey from the BoC with a lot of people concerned about inflation. This was followed by CPI itself, printing in line with consensus, at 4.78%. There was nothing especially surprising about the survey or the CPI print - the BoC expected inflation to be at these levels in October - but the market took these as definitive signals for a rate hike next week in Canada. Consequently, 10y CAD joined the elite club of 'Advanced Economies with Positive Real Rates', with only the Kiwi giving it some company.

One thing that remained unchanged through the week was the pressure on stocks. The narrative was - risk is being repriced to fit the world where real rates are a lot higher, and the Fed put much lower thanks to the Fed's need to fight inflation. Obviously, there were also instances like Netflix, which simply missed expectations. Probably not the greatest start to a year?

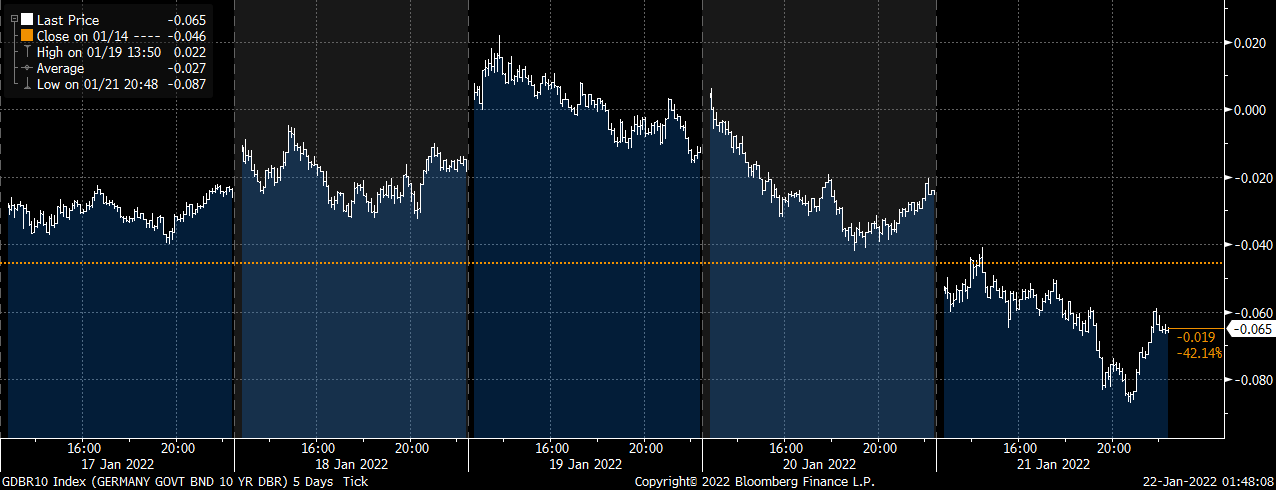

The Ukraine-Russia conflict was also blamed for the risk-off (though Energy should have soared higher in that case?), and either the equity sell-off or conflict (or both) produced a bid for bonds by Wednesday after the liquidation at the beginning of the week. Of course, the real reason was Lord Zoltan jinxing the sell-off by talking about Banks buying fewer USTs as loan demand picks up, and how that would increase net supply as the Fed starts QT and tighten swap spreads. :) So our lives were returned to misery, though for a brief moment in time, the yield on the 10y Bunds was positive.

The narrative that the Fed put is much lower means the bar for pricing out hikes from the front is higher than the bar for bidding the long end. Consequently, the curve has now given up all the steepening from the first week. As long as inflation remains high, expectations of a higher terminal rate may not result in a longer cycle being priced immediately.

Looking ahead, we have the Fed and the BoC next week, along with PMIs, US GDP, and Supply. This week, jobless claims printed weaker than expected, and PMIs would be important to judge whether data is truly turning over. Given the nomination hearings, it would be hard for the Fed to be incrementally hawkish unless they drop QE next week itself, which signals that they will go a lot more than 3-4 times this year. The best we could get from Powell is further clarification on the timing and pace of QT.

Therefore, the main event to watch would be whether the BoC hike or not. If they do, they would be admitting to have made a mistake in December, and signaling that they are behind the curve, which could lead to a big reaction in the curve.